Published: 1 October 2012

Financial position of general government weakened in April to June

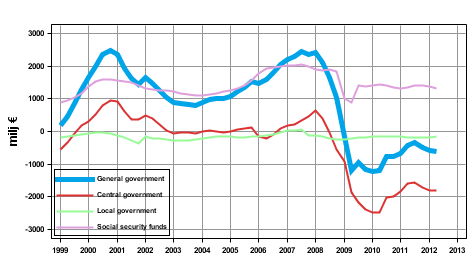

In the second quarter of 2012, general government revenue grew by EUR 0.3 billion from the respective quarter of the previous year. Correspondingly, expenditure increased by EUR 0.8 billion. The difference between revenue and expenditure, that is, the financial position (net lending) of general government weakened by EUR 0.5 billion from the respective quarter of the year before. Total revenue decreased by 2.5 per cent from the previous quarter. Total expenditure did not change from the previous quarter. In the second quarter of 2012, the financial position (net lending) of general gov-ernment showed a surplus of EUR 1.9 billion. These data derive from Statis-tics Finland’s statistics on general government revenue and expenditure by quarter. General government is comprised of central government, local gov-ernment and social security funds..

General governments net lending (+) / net borrowing (-), trend

Examinations of year-on-year changes are made with figures unadjusted for seasonal variation. Central government’s total revenue fell by EUR 82 million from the respective quarter of the year before. The revenue items that decreased most were property income, taxes on production and imports, and income and wealth taxes. Central government’s total expenditure went up by EUR 315 million from the respective quarter of the year before. The expenditure items that increased most were current transfers paid and intermediate consumption. Total revenue of employment pension schemes grew by EUR 97 million year-on-year. The revenue item that grew most was social contri-butions. Property income received by employment pension schemes decreased. Total expenditure of employment pension schemes grew by EUR 402 million. The expenditure item that grew most was social benefits other than social transfers in kind. Total revenue of other social security funds grew by EUR 117 million from the respective quarter of the year before. The revenue item that grew most was current transfers received. Total expenditure of other social security funds decreased by EUR 116 billion. Paid social benefits other than social transfers in kind decreased most. Total revenue of local government grew by EUR 386 million from the respective quarter of the year before. The revenue items that increased most were market output and current transfers received. Total expenditure of local government grew by EUR 430 million. The expenditure items that increased most were intermediate consumption and compensation of employees.

Examinations of changes from the previous quarter are made with seasonally adjusted figures. Central government’s total revenue fell by 3.9 per cent from the previous quarter. The revenue items that decreased most were taxes on production and imports, and income and wealth taxes. Respectively, central government’s total expenditure fell by 1.4 per cent from the previous quarter. The expenditure items that decreased most were subsidies and current transfers paid. Local government’s total revenue went up by 0.6 per cent from the previous quarter. The revenue items that increased were market output and current transfers received. Local government’s total expenditure grew by 0.1 per cent from the previous quarter. The expenditure items that increased most were intermediate consumption and current transfers paid. Total revenue of social security funds fell by 3.4 per cent from the previous quarter. The revenue items that decreased were wealth tax and current transfers received. Total expenditure of social security funds grew by 0.8 per cent from the previous quarter. Paid social benefits other than social transfers in kind increased.

The data for the two latest years are preliminary and will become revised as annual national accounts data are revised. Seasonally adjusted and trend time series have been calculated with the Tramo/Seats method. The change in total revenue and expenditure from the previous quarter has been calculated from seasonally adjusted time series. Seasonally adjusted and trend time series always become revised against new observations irrespective of whether the original time series becomes revised or not. Further information on the seasonal adjustment method: http://www.tilastokeskus.fi/til/tramo_seats_en.html As the time series of annual accounts become revised, the time series of this set of statistics will also be revised. These data are based on the data sources available by 26 September 2012. The data will next be revised at the end of December 2012.

Source: General government revenue and expenditure,nd quarter 2012. Statistics Finland

Inquiries: Jouni Pulkka (09) 1734 3532, Teuvo Laukkarinen (09) 1734 3315, rahoitus.tilinpito@stat.fi

Director in charge: Ari Tyrkkö

Publication in pdf-format (344.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

-

- Appendix figure 1. Social benefits other than social transfers in kind (1.10.2012)

- Appendix figure 2. Actual social contributions (1.10.2012)

- Appendix figure 3.Current Taxes on Income, Wealth, etc., trend (1.10.2012)

- Appendix figure 4. Taxes on Production and Imports (1.10.2012)

- Appendix figure 5. Total revenue, trend (1.10.2012)

- Appendix figure 6. Total expenditure, trend (1.10.2012)

Updated 01.10.2012

Official Statistics of Finland (OSF):

General government revenue and expenditure by quarter [e-publication].

ISSN=1797-9382. 2nd quarter 2012. Helsinki: Statistics Finland [referred: 19.4.2025].

Access method: http://stat.fi/til/jtume/2012/02/jtume_2012_02_2012-10-01_tie_001_en.html