Published: 16 March 2016

General government deficit decreased by EUR 0.5 billion in October to December

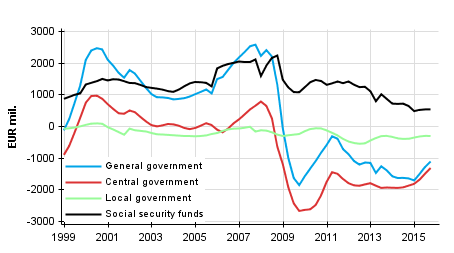

In the fourth quarter of 2015, consolidated total general government revenue grew by EUR 0.6 billion from the respective quarter of the previous year. Correspondingly, consolidated expenditure increased by EUR 0.1 billion. The difference between revenue and expenditure, that is, the deficit (net borrowing) of general government improved by EUR 0.5 billion. Total revenue increased by 1.5 per cent from the previous quarter. Total expenditure grew by 1.0 per cent from the previous quarter. In the fourth quarter of 2015, the general government deficit (net borrowing) stood at EUR 4.4 billion. These data derive from Statistics Finland’s statistics on general government revenue and expenditure by quarter. General government is comprised of central government, local government and social security funds

General government’s net lending (+) / net borrowing (-), trend

Changes from the respective quarter of the year before

Examinations of year-on-year changes are made with figures unadjusted for seasonal variation. In the fourth quarter, central government's total revenue amounted to EUR 13.0 billion and total expenditure was EUR 15.3 billion. Central government's total revenue went up by 2.7 per cent from the respective quarter of the year before. Correspondingly, total expenditure decreased by 2.1 per cent. The difference between revenue and expenditure, that is, the deficit went down by EUR 0.7 billion and amounted to EUR 2.3 billion.

Local government's total revenue was EUR 11.2 billion in the fourth quarter. It increased by 1.7 per cent from the respective quarter of the year before. The revenue items that grew were income taxes received and other direct taxes. In turn, both market output and current transfers received decreased among revenue items. Local government's total expenditure was EUR 13.4 billion in the fourth quarter. It went up by 1.4 per cent. The expenditure items that grew most were paid capital transfers and paid social benefits other than social transfers in kind. The difference between revenue and expenditure, that is, the deficit (net borrowing) of local government was on level with the previous year.

Social security funds include employment pension schemes and other social security funds. In the fourth quarter, employment pension schemes' total revenue amounted to EUR 6.6 billion and total expenditure was EUR 6.3 billion. Total revenue grew by EUR 0.2 billion or by three per cent from the corresponding quarter in the year before and total expenditure increased by EUR 0.4 billion or by six per cent. The revenue items that grew most were social contributions received, and in expenditure, paid social benefits other than social transfers in kind. The difference between revenue and expenditure, that is, the surplus (net lending) of employment pension schemes went down by EUR 0.2 billion from one year back and amounted to EUR 0.3 billion.

Other social security funds' total revenue was EUR 4.7 billion in the fourth quarter. Total revenue decreased by 2.4 per cent from the corresponding quarter of one year ago. The expenditure of other social security funds amounted to EUR 4.9 billion, which was 1.9 per cent higher than one year ago. The expenditure item that grew most was paid social benefits other than social transfers in kind. The difference between revenue and expenditure, that is, the deficit (net borrowing) of social security funds was EUR 225 million in the last quarter.

Changes from the previous quarter

Examinations of changes from the previous quarter are made with seasonally adjusted figures. Central government's total revenue grew by 2.4 per cent from the previous quarter. Respectively, central government's total expenditure fell by 0.2 per cent from the previous quarter.

Local government's total revenue went up by 0.5 per cent from the previous quarter. Local government's total expenditure grew by 1.2 per cent from the previous quarter.

Employment pension schemes' total revenue went up by 1.2 per cent and total expenditure grew by 1.8 per cent from the previous quarter. Other social security funds' total revenue grew by 0.2 per cent from the previous quarter. Correspondingly, total expenditure grew by 0.6 per cent.

The data for the two latest years are preliminary and will become revised as annual national accounts data are revised. Seasonally adjusted and trend time series have been calculated with the Tramo/Seats method. Seasonally adjusted and trend time series always become revised against new observations irrespective of whether the original time series becomes revised or not. Further information on the seasonal adjustment method : http://www.tilastokeskus.fi/til/tramo_seats_en.html As the time series of annual national accounts become revised, the time series of this set of statistics will also be revised. These data are based on the data sources available by 10 March 2016. The data will be next revised on 22 June 2016.

Source: General government revenue and expenditure,4th quarter 2015. Statistics Finland

Inquiries: Jouni Pulkka 029 551 3532, Teuvo Laukkarinen 029 551 3315, Anu Karhu 029 551 3325, Kirsi Peltonen 029 551 3464, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (390.9 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

-

- Appendix figure 1. Social benefits other than social transfers in kind (16.3.2016)

- Appendix figure 2. Actual social contributions (16.3.2016)

- Appendix figure 3.Current Taxes on Income, Wealth, etc., trend (16.3.2016)

- Appendix figure 4. Taxes on Production and Imports (16.3.2016)

- Appendix figure 5. Total revenue, trend (16.3.2016)

- Appendix figure 6. Total expenditure, trend (16.3.2016)

- Appendix figure 7. Final Consumption expenditure, trend (16.3.2016)

- Appendix figure 8. Gross savings, trend (16.3.2016)

- Revisions in these statistics

-

- Revisions in these statistics (16.3.2016)

Updated 16.03.2016

Official Statistics of Finland (OSF):

General government revenue and expenditure by quarter [e-publication].

ISSN=1797-9382. 4th quarter 2015. Helsinki: Statistics Finland [referred: 19.4.2025].

Access method: http://stat.fi/til/jtume/2015/04/jtume_2015_04_2016-03-16_tie_001_en.html