Published: 30 September 2015

General government EDP debt grew by EUR 4.4 billion in the second quarter of 2015

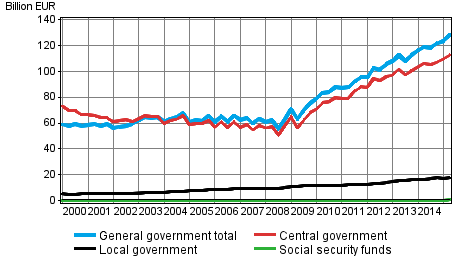

General government EDP debt, or consolidated debt at nominal prices, grew by EUR 4.4 billion in the second quarter of 2015 and stood at EUR 128.3 billion at the end of the quarter. Compared with the respective period of the year before, general government debt has increased by a total of EUR 8.9 billion. These data derive from Statistics Finland's statistics on general government debt by quarter.

General government debt by quarter

During the second quarter of 2015, central government debt grew by EUR 3.1 billion and stood at EUR 112.9 billion at the end of the quarter. The stock of short-term debt securities grew by EUR 3.3 billion and the stock of bonds by EUR 1.3 billion. At the same time, the stock of short-term loans decreased by EUR 1.6 billion and the stock of long-term loans remained almost on level with the previous quarter. Local government debt, that is, the debt of municipalities and joint municipal boards, increased by EUR 0.3 billion in the second quarter and totalled EUR 17.7 billion at the end of the quarter. In addition, social security funds’ debt grew by EUR 0.7 billion as a result of issuing of bonds.

General government EDP debt describes general government’s debt to other sectors of the national economy and to the rest of the world, and its development is influenced by changes in unconsolidated debt and internal general government debts. Consolidated general government gross debt is derived by deducting debts between units recorded under general government from unconsolidated gross debt. For this reason, general government debt is smaller than the combined debts of its sub-sectors.

Central government's EDP debt as a concept differs in the case of central government from the central government debt published by the State Treasury. Central government's EDP debt includes loans granted to beneficiary counties by the European Financial Stability Facility EFSF, received cash collaterals related to derivative contracts, the capital of the Nuclear Waste Management Fund, debts generated from investments in central government's PPP (public-private partnership) projects, coins that are in circulation, and the deposits of the European Commission. In National Accounts, central government is also a broader concept than the budget and financial economy. The valuation principle for both debt concepts is the nominal value, where the effect of currency swaps is taken into account.

Source: General government debt by quarter, Statistics Finland

Inquiries: Timo Ristimäki 029 551 2324, Teuvo Laukkarinen 029 551 3315, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (209.0 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Revisions in these statistics

-

- Revisions in these statistics (30.9.2015)

Updated 30.09.2015

Official Statistics of Finland (OSF):

General government debt by quarter [e-publication].

ISSN=1799-8034. 2nd quarter 2015. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/jyev/2015/02/jyev_2015_02_2015-09-30_tie_001_en.html