This set of statistics has been discontinued.

Statistical data on this topic are published in connection with another set of statistics.

Data published after 5 April 2022 can be found on the renewed website.

Published: 30 September 2016

Government sector’s net financial assets on the rise in the second quarter of 2016

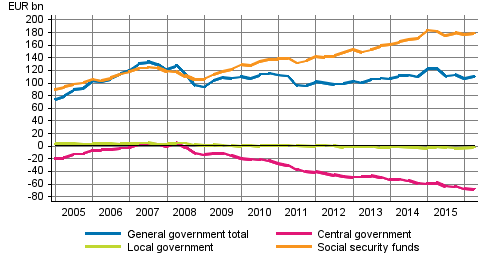

At the end of the second quarter of 2016, general government's net financial assets, i.e. difference between their financial assets and liabilities, amounted to EUR 110.1 billion. During the quarter, the net financial assets of central government decreased in total by EUR 0.1 billion. The net financial assets of local government continued to grow, now by EUR 0.9 billion. The net financial assets of employment pension schemes and social security funds were also growing, up by EUR 2.5 billion. In total, general government's net financial assets went up by EUR 3.3 billion. These data derive from general government financial accounts compiled by Statistics Finland.

General government’s net financial assets

Central government's net financial assets fell by EUR 0.1 billion from the previous quarter's level, being EUR -67.4 billion at the end of the quarter. Both central government assets and liabilities declined during the quarter. Assets went down slightly more than liabilities, which led to a slight fall in net financial assets. Of assets, deposits were falling and of liabilities, long-term bonds.

Local government's net financial assets rose by EUR 0.9 billion. Local government's liabilities went down and assets, in turn, increased. Net financial assets stood at EUR -1.5 billion at the end of the quarter. Of assets, transferable deposits were growing, and of liabilities, long-term loans were falling. Local government's liabilities have been falling in the first two quarters of the year.

Employment pension schemes' net financial assets were EUR 177.1 billion at the end of the period, rising by EUR 2.6 billion from the previous quarter. Most of the rise in employment pension schemes' net financial assets has come from mutual fund shares. Their holding gains have grown over the period by around EUR 2.2 billion. In addition, employment pension schemes have transferred their assets from deposits to foreign mutual fund shares and bonds. Employment pension schemes' total assets totalled EUR 182.2 billion in the second quarter.

From the beginning of 2016, specified information has been available on cash collateral related to employment pension schemes' derivative contracts and securities lending. These items were previously included in other accounts receivable/payable. Now cash collateral is transferred to short-term loans. Other accounts payable has been re-examined also because specified information on short-term liabilities generated for the duration of the clearing and settlement of securities transactions has similarly been available from the beginning of 2016. At this point, the time series revisions concern the years 2012 to 2016. The time series may change more later on.

Other social security funds' lending increased considerably over the past few years. Now the amount of liabilities has turned to slight decline. Assets also fell slightly from the previous quarter, so other social security funds' net financial assets remained unchanged at EUR 1.9 billion.

Source: General government financial accounts, Statistics Finland

Inquiries: Lea Vuorinen 029 551 3642, Henna Laasonen 029 551 3303, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (229.2 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 30.09.2016

Official Statistics of Finland (OSF):

General government financial accounts [e-publication].

ISSN=1798-1964. 2nd quarter 2016. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/jyrt/2016/02/jyrt_2016_02_2016-09-30_tie_001_en.html