This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 18 March 2015

Outstanding credit stood at EUR 92 billion at the end of December 2014

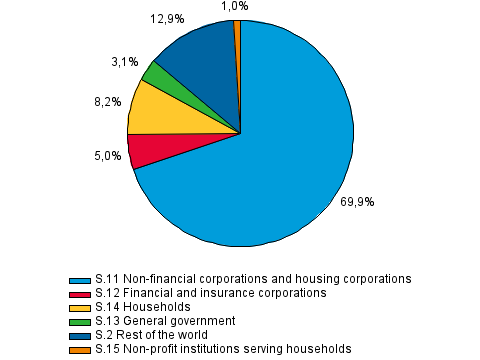

Outstanding credits granted by other Finnish financial and insurance corporations and general government amounted to EUR 92 billion at the end of December 2014. Finnish companies granted a total of EUR two billion in new credits during the quarter. In outstanding credit, the total stock of lending in euros and other currencies amounted to EUR 27 billion, bonds at nominal prices to nearly EUR 59 billion and money market instruments to EUR six billion. This is indicated by Statistics Finland’s statistics on outstanding credit.

Lending by financial asset category at the end of the 4th guarter of 2014, per cent

Lender sector: Other financial and insurance corporations and general government

Among lenders, other financial corporations granted EUR four billion in credits to business activities

Credits granted by other Finnish financial corporations, excluding insurance corporations and general government, to businesses, non-financial corporations and households of own-account workers amounted to EUR four billion, of which the largest share, nearly 24 per cent, was directed to manufacturing.

Households' outstanding credit was EUR two billion

The credit stock granted by other Finnish financial corporations, (including microloan companies and pawn brokers, excl. insurance corporations and general government) stood at EUR two billion at the end of December, of which consumption credits accounted for 95 per cent.

During the quarter, 131,636 new small loans were granted

During the fourth quarter of 2014, a total of 131,636 new small loans, or so-called quick loans, were granted to households, amounting to nearly EUR 41 million. During the quarter, close on 29 per cent fewer new euro-denominated loans were granted than in the corresponding quarter of the year before, and nearly five per cent more than in the previous quarter. The average quick loan in the fourth quarter of the year amounted to EUR 308 and the average repayment period was 81 days.

In total, borrowers of small loans paid close on EUR seven million in different types of costs on small loans taken out in October to December. This is 27 per cent less than in the year before. The costs directed at small loans were 16 per cent of the granted new loans during the quarter. In the fourth quarter of 2014, the statistics included 47 small loan companies.

The changes in the small loans are the result of a legislation amendment that came into force on 1 June 2013 based on which a 51 per cent interest rate ceiling was placed on small loans. http://www.oikeusministerio.fi/fi/index/ajankohtaista/tiedotteet/2013/03/pienilleluotoille51prosentinkorkokattokesakuunalusta.html As a result of this, some small loan companies closed down their operation and some renewed their services more towards so-called flexible credits.

Source: Outstanding credit, Statistics Finland

Inquiries: Kerttu Helin 029 551 3330, Sari Kuisma 029 551 2645, luottokanta.rahoitus@stat.fi

Director in charge: Leena Storgårds

Publication in pdf-format (268.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Outstanding credit by financial asset in 2013-2014, EUR million (18.3.2015)

- Appendix table 2. Credit granted by other financial corporations to households by purpose of use in 2013-2014, EUR million (18.3.2015)

- Appendix table 3. Key figures of small loan companies in 2013-2014 (18.3.2015)

- Figures

-

- Appendix figure 1. Lending by financial asset category at the end of the 4th guarter of 2014, per cent (18.3.2015)

- Appendix figure 2. Business loans of other financial intermediaries, percent (18.3.2015)

- Appendix figure 3. New credits and credit stock of small loan companies in 2013 to 2014 (18.3.2015)

Updated 18.3.2015

Official Statistics of Finland (OSF):

Outstanding credit [e-publication].

ISSN=2342-2661. 4th quarter 2014. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/lkan/2014/04/lkan_2014_04_2015-03-18_tie_001_en.html