This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 18 March 2016

Outstanding credit remained at EUR 96 billion at the end of December 2015

Outstanding credits granted by other Finnish financial and insurance corporations and general government remained at EUR 96 billion at the end of December 2015 as well. Finnish companies granted a total of EUR two billion in new credits during the quarter. In outstanding credit, the total stock of lending in euros and other currencies amounted to EUR 28 billion, bonds at nominal prices to EUR 64 billion, and money market instruments to EUR four billion. This is indicated by Statistics Finland’s statistics on outstanding credit.

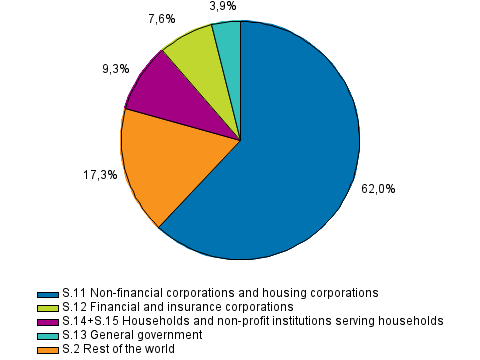

Lending by financial asset gategory at the end of the 4th guarter of 2015, per cent

Lender sector: Other financial and insurance corporations and general government

Among lenders, other financial corporations granted EUR four billion in credits to business activities

Credits granted by other Finnish financial corporations, excluding insurance corporations and general government, to businesses, non-financial corporations and households of own-account workers amounted to EUR four billion, of which the largest share, 21 per cent, was directed to manufacturing.

Households' outstanding credit remained at EUR two billion

The credit stock granted by other Finnish financial corporations (including microloan companies and pawn brokers, excl. insurance corporations and general government) to households also stood unchanged at EUR two billion in the fourth quarter. The share of consumption credits also remained unchanged at 95 per cent.

During the quarter, 118,137 new small loans were granted

During the fourth quarter of 2015, a total of 118,137 new small loans, or so-called quick loans, were granted to households, amounting to nearly EUR 64 million. During the quarter, close on 58 per cent more new euro-denominated loans were granted than in the corresponding quarter of the year before, and 26 per cent less than in the previous quarter. The average quick loan in the fourth quarter of the year amounted to EUR 541 and the average repayment period was nearly 165 days.

In total, borrowers of small loans paid close on EUR nine million in different types of costs on small loans taken out in October to December. This is 28 per cent more than in the year before. The costs directed at small loans were 13 per cent of the granted new loans during the quarter. In the fourth quarter of 2015, the statistics included 46 small loan companies.

The changes in small loans are the result of a legislation amendment that came into force on 1 June 2013 based on which a 51 per cent interest rate ceiling was placed on small loans. As a result of this, some small loan companies closed down their operation and some renewed their services more towards so-called flexible credits.

Source: Outstanding credit, Statistics Finland

Inquiries: Kerttu Helin 029 551 3330, Sari Kuisma 029 551 2645, luottokanta.rahoitus@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (261.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Outstanding credit by financial asset in 2014-2015, EUR million (18.3.2016)

- Appendix table 2. Credit granted by other financial corporations to households by purpose of use in 2014-2015, EUR million (18.3.2016)

- Appendix table 3. Key figures of small loan companies in 2014-2015 (18.3.2016)

- Figures

-

- Appendix fiqure 1. Lending by financial asset gategory at the end of the 4th guarter of 2015, per cent (18.3.2016)

- Appendix fiqure 2. Business loans of other financial intermediaries, percent (18.3.2016)

- Appendix fiqure 3. New credits and credit stock of small loan companies in 2014 to 2015 (18.3.2016)

Updated 18.3.2016

Official Statistics of Finland (OSF):

Outstanding credit [e-publication].

ISSN=2342-2661. 4th quarter 2015. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/lkan/2015/04/lkan_2015_04_2016-03-18_tie_001_en.html