Published: 14 June 2019

Current account showed a surplus in the first quarter, net international investment position strengthened

Correction on 14 June 2019 at 8:40 am. The Correction is indicated in red

The current account was in surplus in the first quarter of 2019. The value of goods exports in balance of payments terms increased by 4 per cent and the value of service exports by 7 per cent. Net exports of goods turned positive. In addition to goods trade, the primary income account was also positive. The net international investment position strengthened. The data appear from Statistics Finland's statistics on balance of payments and international investment position.

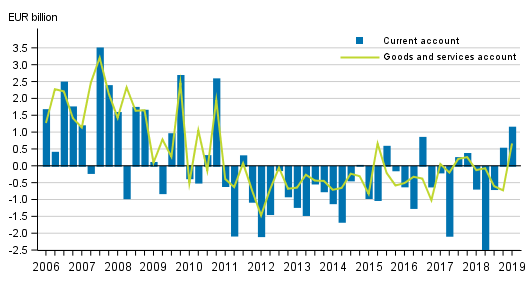

Current account and goods and services account

Current account

In the first quarter of 2019, the current account was EUR 1.2 billion in surplus. The balance of goods and services showed a surplus of EUR 0.7 billion. Of the sub-items of the current account, the primary income account was EUR 0.8 billion in surplus and the secondary income account EUR 0.3 billion in deficit.

Goods and services

The trade account in balance of payments terms was EUR 1.1 billion in surplus in the first quarter of 2019. In the corresponding quarter of the previous year, the trade account surplus amounted to EUR 0.2 billion. The service account showed a deficit of EUR 0.5 billion in the first quarter of 2019. The deficit in the service account is explained in particular by strengthening imports of telecommunications, computer and information services and other business services compared to the corresponding quarter of the previous year.

Goods exports in balance of payments terms amounted EUR 16.0 billion in the first quarter of 2019, which means that goods exports strengthened by 4 per cent from the corresponding period of 2018. Goods imports declined to EUR 14.9 billion or by 2 per cent year-on-year. In the first quarter of 2019, service exports grew by 7 per cent and service imports by 9 per cent compared to the corresponding quarter of the previous year. Service exports amounted to EUR 7.0 billion and service imports to EUR 7.5 billion and, thus, the service account again showed a deficit.

More detailed import and export figures in balance of payments terms by service item and area can be found in the statistics on international trade in goods and services starting from 2015. Decreases and increases made to the Finnish Customs figures, which result in goods trade in balance of payments terms, are also broken down in the statistics on international trade in goods and services.

Primary income in the first quarter

The primary income account was EUR 0.8 billion in surplus in the first quarter of 2019. The primary income account includes compensation of employees, investment income and other primary income paid abroad from Finland and from abroad to Finland. The surplus of primary income was mainly due to investment income, which includes such as returns on capital like interests and dividends. EUR 0.6 billion were paid in investment income in net to Finland in the first quarter of 2019.

The secondary income account was EUR 0.3 billion in deficit in the first quarter of 2019.

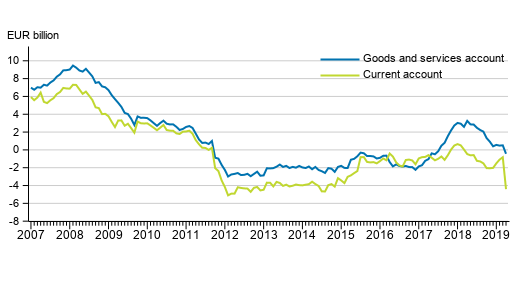

Current account in deficit in April 2019

The current account was EUR 4.2 billion in deficit in April. The value of goods exports in balance of payments terms decreased by 8 per cent from twelve months back. Primary income showed deficit due to a strong increase in investment income debits. Increase in investment income debits are due to international company restructurings at the end of last year. The final contribution of these restructurings in balance of payments will be available in September 2020 when annual data for statistical year 2019 is updated. Also the trade account in balance of payments terms, the service account and the secondary income account were in deficit.

Finland’s current account and goods and services account, 12 –month moving sum

Financial account and net international investment position

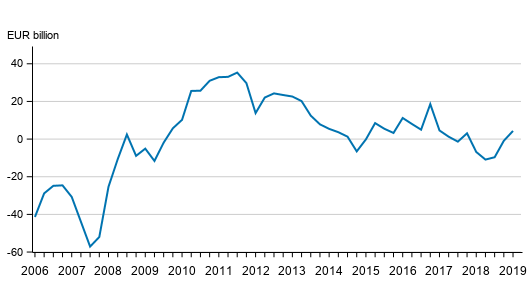

Net international investment position strengthened from the previous quarter

At the end of the first quarter of 2019, Finland had EUR 811.2 billion in foreign assets on gross and EUR 806.9 billion in foreign liabilities on gross. The net international investment position, that is, the difference between the stock of assets and liabilities, was thus EUR 4.3 billion as there were more assets than liabilities.

The net international investment position improved from the previous quarter when the net international investment position was EUR -0.9 billion. Financial transactions stood for EUR 1.6 billion and changes in classifications and other valuation changes for EUR 3.7 billion of the change in the net international investment position.

The stock of international assets and liabilities grew strongly in the last quarter of 2018 as the result of a significant company restructuring, and the growth in the stock of assets and liabilities continued also in the first quarter of 2019. Foreign assets grew most through increases and valuation changes in cash and deposits, as well as equity and investment fund shares. The stock of liabilities grew as a result of increases in cash and deposits, as well as debt securities.

Finland’s net international investment position quarterly

Capital outflow from Finland in the form of other investments

Examined by type of investment, the biggest net assets, EUR 37.6 billion were in direct investments. The net assets of other investments amounted to EUR 28.5 billion. Highest net liabilities, EUR 69.6 billion were in portfolio investments, which is explained by the stock of liabilities in bonds and money market instruments. Assets were higher than liabilities in equity and investments fund shares.

In the first quarter of 2019, net capital outflow from Finland was largely in form of other investments. The primary financial assets in this type of investment are cash and deposits, as well as loans. Capital inflow to Finland was in the form of portfolio investments.

Examined by investor sectors, foreign assets increased most in the central bank sector and other monetary financial institutions. Growth in the stock of liabilities is due to the growth in the liabilities of other monetary financial institutions and enterprises. When the net investment position is examined by sector, social security funds had most net foreign assets, EUR 147.9 billion, of which employment pension schemes comprise the majority. EUR 113.7 billion of social security funds’ net foreign assets were in shares and mutual fund shares. Other monetary financial institutions, EUR 133.9 billion and enterprises, EUR 95.9 billion had most net liabilities.

The flow data of the financial account were revised for 2017 and 2018. The biggest revisions applied to the net flow of investment fund shares, equity and bonds.

Financial account in April 2019

Financial account showed net capital outflow of EUR 2.6 billion. By functional category, net capital outflow of EUR 8.3 billion was in form of other investments and net capital inflow of EUR 5.8 billion in form of portfolio investments.

Source: Balance of payments and international investment position, Statistics Finland

Inquiries: Hanna Björklund 029 551 3296, Risto Sippola 029 551 3383, balanceofpayments@stat.fi.

Director in charge: Ville Vertanen

Publication in pdf-format (340.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Current account, quarterly 2019, EUR million (14.6.2019)

- Appendix table 2. External assets and liabilities by sector, quarterly 2019, EUR million (14.6.2019)

- Appendix table 3. International investment position by sector, quarterly 2019, EUR million (14.6.2019)

- Appendix table 4. Balance of payments, EUR million (14.6.2019)

Updated 14.06.2019

Official Statistics of Finland (OSF):

Balance of payments and international investment position [e-publication].

ISSN=2342-348X. April 2019. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/mata/2019/04/mata_2019_04_2019-06-14_tie_001_en.html