Published: 4 April 2014

Households’ financial assets grew by EUR 5 billion in the last quarter of 2013

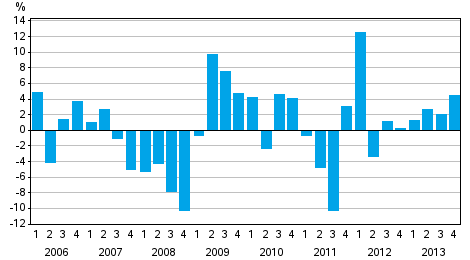

Households’ financial assets grew by EUR 5.0 billion during the last quarter of 2013. Households' debts also grew moderately, by EUR 0.2 billion. Households' financial assets have grown more than their debts already in six quarters in succession. At the end of 2013, the difference between households' financial assets and debts, i.e. net financial assets, amounted to EUR 110.6 billion. These data derive from Statistics Finland’s financial accounts statistics.

Change from the previous quarter in households’ net financial assets

At the end of 2013, households had a total of EUR 246.5 billion in financial assets and EUR 135.9 billion in debts. During the last quarter, financial assets grew more than debts, as a result of which households' net financial assets increased by 4.5 per cent, rising to EUR 110.6 billion. Net financial assets refer to the difference between financial assets and liabilities.

During the fourth quarter of 2013, both investments made by households and holding gains increased households' financial assets. Households received EUR 3.0 billion of holding gains mainly from quoted shares and mutual funds. Households' net investments in turn amounted to EUR 1.9 billion. In their investments in the fourth quarter, households favoured cash deposits and quoted shares.

Both households' loan debts and disposable income increased in the last quarter. As a result of changes, the indebtedness ratio grew slightly, to 119.3 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

In the last quarter, non-financial corporations decreased their debt financing by cutting back both their loans and debt securities. During the quarter, non-financial corporations' debt financing fell by altogether EUR 4.3 billion, being EUR 202.0 billion at the end of the year. Debt financing refers to the total of loan debts and financing in the form of debt securities.

The time series of financial accounts have become revised. Changes have taken place in the whole period starting from 1997, and the changes are not limited to certain assets or sectors. The biggest revisions concern loans and deposits between financial institutions and unquoted shares. Data on general government have changed the least.

The time series correction is connected to combining the compilation of quarterly and annual financial accounts. Previously, quarterly financial accounts and annual financial accounts were compiled separately from one another. Therefore, there were two times series for the financial accounts, which were not fully congruent. Nowadays, the quarterly and annual calculations are made in the same integrated process and now the time series have also been harmonised.

Source: Financial accounts, Statistics Finland

Inquiries: Saara Roine 09 1734 2922, Martti Pykäri 09 1734 3382, rahoitus.tilinpito@stat.fi

Director in charge: Leena Storgårds

Publication in pdf-format (266.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 4.4.2014

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 4th quarter 2013. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/rtp/2013/04/rtp_2013_04_2014-04-04_tie_001_en.html