Published: 23 December 2014

Households’ net financial assets decreased in the third quarter of 2014

In the third quarter of 2014, households' net financial assets decreased by one per cent when compared to the previous quarter. This was caused by households' financial assets remaining almost unchanged while their liabilities continued growing. Net financial assets refer to the difference between financial assets and liabilities. These data derive from Statistics Finland’s financial accounts statistics.

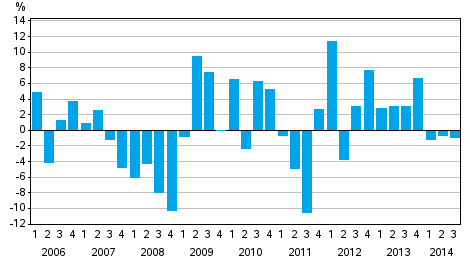

Change from the previous quarter in households´ net financial assets

At the end of the third quarter 2014, households had a total of EUR 262.6 billion in financial assets and EUR 141.2 billion in liabilities. During the quarter, financial assets remained more or less unchanged but liabilities grew by EUR 1.1 billion. As a result of these changes, households' net financial assets decreased and stood at EUR 121.4 billion at the end of the quarter.

During the third quarter of 2014, households' net investments totalled EUR 0.1 billion. Households did, however, withdraw assets from deposits and invest them in funds and insurance policies. The popularity of funds has increased for a long time, as households' net investments in mutual fund shares have been positive for nine successive quarters.

Both households' loan debts and disposable income increased in the third quarter. As a result of the changes, households' indebtedness ratio increased to 122.2 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters. The time series of households' loan debts was revised and, as a result, the indebtedness ratio increased for the entire time series, varying between 0.8 and 1.5 percentage points.

Non-financial corporations debt financing grew by EUR 2.9 billion in the third quarter. Non-financial corporations had EUR 169.6 billion in loan debt and EUR 36.7 billion debt in the form of debt securities. Debt financing refers to the total of loan debts and financing in the form of debt securities.

Source: Financial accounts, Statistics Finland

Inquiries: Saara Roine 029 551 2922, rahoitus.tilinpito@stat.fi

Director in charge: Leena Storgårds

Publication in pdf-format (269.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 23.12.2014

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 3rd quarter 2014. Helsinki: Statistics Finland [referred: 19.4.2025].

Access method: http://stat.fi/til/rtp/2014/03/rtp_2014_03_2014-12-23_tie_001_en.html