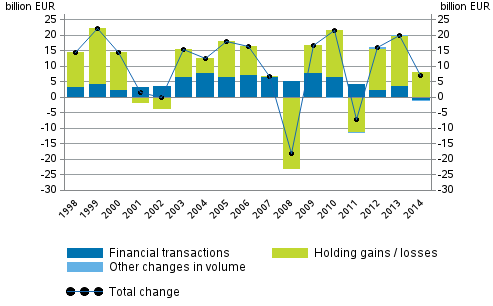

1. Holding gains helped maintain the growth in households’ net financial assets in 2014

Households' financial assets grew by EUR seven billion in 2014. This happened despite the fact that households' net investments in financial assets were close on EUR one billion negative. The growth in financial assets was particularly caused by holding gains generated by higher stock market prices. Altogether, households' holding gains amounted to EUR eight billion in 2014. This was, however, only around one-half of the 2013 level when the rise in stock market prices was even brisker.

When examining the overall development of financial assets and liabilities, holding gains helped keep households’ net financial assets on the growth path. As households' borrowing amounted to EUR five billion in 2014, net financial assets grew by EUR two billion and amounted to close on EUR 120 billion.

Figure 1. Change in financial assets of households, EUR billion

Even though households’ net investments as whole in all financial assets decreased in 2014, investment in some financial instruments increased. In terms of deposits, the shift in focus from fixed-term deposits to cash deposits that has been visible for a couple of years continued. Households withdrew nearly EUR four billion from fixed-term deposits while their cash deposits increased by more than EUR three billion.

Households also withdrew assets from quoted shares but continued to acquire mutual fund shares as in previous years. In terms of quoted shares, the net decrease was around EUR two billion while EUR 1.3 billion was invested in mutual fund shares.

Overall, households’ financial assets amounted to EUR 262 billion at the end of 2014. Of these, EUR 79 billion were deposits, EUR 65 billion unquoted shares and equity, EUR 48 billion insurance and pension technical reserves, EUR 29 billion quoted shares, and almost EUR 19 billion mutual fund shares. The value of other financial assets held by households was EUR 21 billion. Households' shares in housing companies are not recorded in financial accounts as financial assets.

Households' debts continued to grow, now slightly faster than in 2013. Their loan debt increased by EUR 4.7 billion during 2014, reaching over EUR 132 billion at the end of the year. The indebtedness rate, i.e. the proportion of loans relative to disposable income, rose by 3.7 percentage points to 121.7 per cent. As a result of holding gains, households' financial assets increased more than their debts. Thus households' net financial assets grew by EUR two billion to close on EUR 120 billion.

1.1. General government’s financial position remained unchanged

General government's financial position remained roughly at last year's level growing by good EUR one billion in 2014. This is the case despite the fact that the net financial assets of central government declined by EUR 10 billion. At the end of 2014, general government's financial assets stood at EUR 111 billion. The fact that all general government was able to maintain their financial position is explained by an increase of EUR 12 billion in the net financial assets of employment pension schemes that belong to social security funds. The decrease in local government's net financial assets slowed down and the decline amounted only to EUR 0.2 billion.

The weakening of the central government's balance sheet position which started in 2008 steepened. During 2014, central government's net financial assets contracted by EUR 10 billion to EUR -59 billion. The speed actually exceeded the 2012 level when net financial assets decreased by close on EUR eight billion. The main reason for decreasing net financial assets was that the central government accumulated assets by issuing bonds.

During 2014, net financial assets of employment pension schemes increased from EUR 158 billion to EUR 170 billion. The growth in employment pension schemes' net financial assets was caused by considerable holding gains. The fact that the market value of quoted shares and fund shares owned by employment pension schemes grew by more than EUR 10 billion was mainly responsible for the growth in net financial assets in the sector.

Employment pension schemes' net investments in financial assets decreased from over EUR six billion in 2013 to zero in 2014. In 2014, employment pension schemes' financial asset investments focused on unquoted shares and fund shares while, for example, net transactions in debt securities and quoted shares turned negative.

1.2. Non-financial corporations decreased debt financing

Non-financial corporations' debt financing decreased during 2014. Debt financing refers to the total of loan debts and financing in the form of debt securities. Over the year, non-financial corporations' debt financing decreased from EUR 216 billion to EUR 205 billion. Non-financial corporations reduced both their loan debts and financing in the form of debt securities.

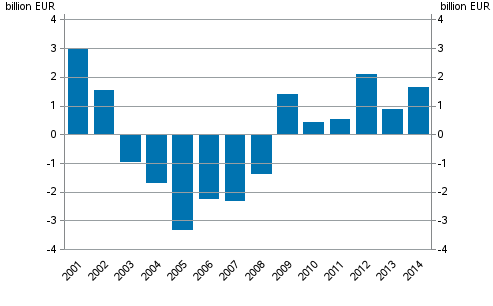

Non-financial corporations doubled their acquisition financing through issuing new equity on the stock market from 2013. In 2014, quoted enterprises issued new shares to the total net value of EUR 1.6 billion. Negative figures for previous years are related to buybacks of own shares.Figure 2. Net emissions of quoted shares by non-financial corporations, EUR billion

1.3. Growth in domestic mutual funds continued

Domestic mutual funds grew by a total of EUR 10 billion in 2014. One-half of the growth was generated through net investments while the other half consisted of holding gains from funds. Particularly financial and insurance corporations, as well as households invested in investment funds during the year.

1.4. Foreign holdings in Finnish quoted shares rose to 50 per cent

Foreign net investments to Finland were EUR 16 billion. Foreign investors particularly increased their holdings in Finnish debt securities and quoted shares last year. The share of loans in foreign investments was also considerable.

At the end of the year, the value of foreign share holdings in Finnish quoted shares was EUR 79 billion. The proportion of foreign ownership of the value of Finnish quoted shares increased by three percentage points to 50 per cent.

Of foreign investment instruments, particularly bonds and shares were favoured by Finns in 2014. At the end of the year, Finnish units owned EUR 61 billion worth of foreign quoted shares and EUR 79 billion worth of domestic quoted shares. Finns owned EUR 85 billion in foreign fund shares while the level for domestic fund shares was EUR 72 billion. The growth of over EUR 12 billion in foreign fund shares owned by Finns was mainly generated through holding gains as actual net investments of domestic investors in foreign funds was only around EUR one billion.

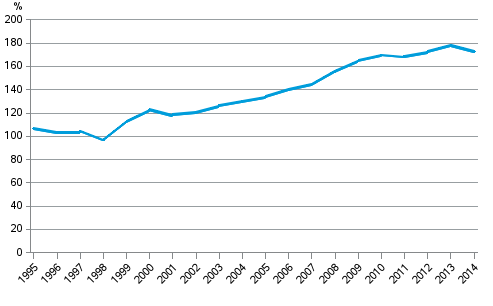

1.5. Private sector debt decreased

Private sector debt declined by EUR six billion last year. Simultaneously, the GDP share of the debt fell by five percentage points to 172.9 per cent, which is close to the 2012 level. Private sector debt comprises the loan debts and debts in the form of debt securities of non-financial corporations, households and non-profit institutions serving households.Figure 3. Non-consolidated private sector debt as percentage of GDP

Source: Financial Accounts, Statistics Finland

Inquiries: Peter Parkkonen 029 551 2571, rahoitus.tilinpito@stat.fi

Deputy director in charge: Mari Yl�-Jarkko

Updated 9.7.2014

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2014,

1. Holding gains helped maintain the growth in households’ net financial assets in 2014

. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/rtp/2014/rtp_2014_2015-07-09_kat_001_en.html