Published: 30 September 2015

Households’ indebtedness ratio rose to 123.2 per cent in the second quarter of 2015

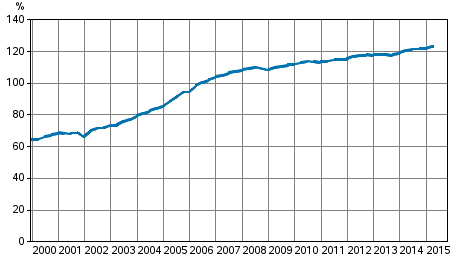

Households' indebtedness rose by 1.4 per cent to 123.2 per cent in the second quarter of 2015. Compared to the year before, the change in the indebtedness ratio was 2.7 percentage points. The data appear from Statistics Finland's financial accounts statistics.

Households’ indebtedness ratio

During the second quarter of 2015, households' loan debts increased by EUR 1.7 billion to EUR 134.8 billion. Households' disposable income in turn remained almost unchanged. As a result of this, households' indebtedness ratio rose to 123.2 per cent. Households' indebtedness ratio is calculated as the ratio of their loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

At the end of June, households had a total of EUR 272.7 billion in financial assets and EUR 144.7 billion in debts. During the second quarter, financial assets decreased by EUR 1.3 billion and debts by EUR 2.2 billion. As a result of these changes, households' net financial assets decreased and stood at EUR 128.0 billion at the end of the quarter.

The reduction in households' financial assets was due to holding losses. As the stock exchange rates fell, the market values of households' quoted shares and mutual fund shares decreased. Households' net investments amounted to EUR 2.1 billion during the quarter, but it was not enough to compensate for the effect of holding losses on financial assets.

Households withdrew assets from quoted shares and mutual fund shares. In contrast, households relied on deposits, on which they invested EUR 1.6 billion in net amounts during the quarter.

Non-financial corporations' debt financing grew by EUR 4.1 billion in the second quarter. Non-financial corporations had EUR 191.9 billion in loan debt and EUR 32.6 billion debt in the form of debt securities. Debt financing refers to the total of loan debts and financing in the form of debt securities

Source: Financial accounts, Statistics Finland

Inquiries: Saara Roine 029 551 2922, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (258.5 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (30.9.2015)

Updated 30.9.2015

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2nd quarter 2015. Helsinki: Statistics Finland [referred: 9.3.2025].

Access method: http://stat.fi/til/rtp/2015/02/rtp_2015_02_2015-09-30_tie_001_en.html