Published: 28 September 2018

Households’ net financial assets increased slightly in the second quarter of 2018

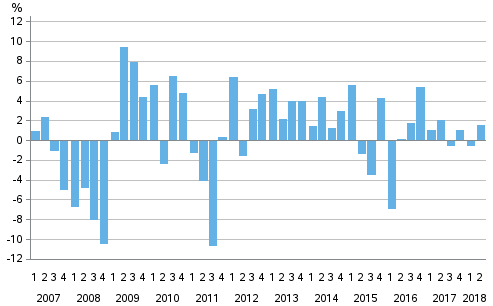

Households' financial assets grew by EUR 5.5 billion during the second quarter of 2018. At the end of the quarter, households had financial assets, such as deposits, shares and mutual fund shares, to the value of EUR 307.6 billion. Over the same period, households had EUR 166.7 billion in debt, which was EUR 3.3 billion up from the previous quarter. As a result of these changes, the difference of households’ net financial assets and liabilities, or net financial assets grew by EUR 2.2 billion to EUR 140.9 billion in April to June. These data appear from Statistics Finland's financial accounts statistics.

Change from the previous quarter in households’ net financial assets

Households’ gains from shares cumulated current accounts

During the second quarter of 2018, households increased their net investments in financial assets by EUR 3.6 billion. Assets flowed particularly to current accounts, other transferable deposits and wallets to the tune of EUR 2.7 billion on net on account of enterprises’ dividend payment in spring, for example. Households generated holding gains from shares and equity to the value of EUR 1.8 billion and from mutual fund shares to the value of EUR 0.4 billion. Changes in most other financial assets and liabilities were minor.

Households’ indebtedness ratio 128.7 per cent

At the end of June, households had EUR 151.4 billion in housing loans and other loan debt, which amount increased by EUR 2.6 billion from the previous quarter. Households' indebtedness ratio was 128.7 per cent. The indebtedness ratio is calculated as the ratio of households’ loan debts at the end of a quarter to their total disposable income during the preceding four quarters.

Non-financial corporations’ debt financing increased in April to June

Non-financial corporations’ debt financing grew by EUR 4.3 billion during the second quarter of 2018 to EUR 249.6 billion. Debt financing includes commercial papers and other debt securities issued by non-financial corporations and loan debts of non-financial corporations. Financing in the form of debt securities increased by EUR 1.4 billion and rose to EUR 31.7 billion. Non-financial corporations' loan debts grew by EUR 2.9 billion to EUR 217.9 billion. Here, the non-financial corporations sector does not include housing companies or other housing corporations.

Source: Financial accounts, Statistics Finland

Inquiries: Henna Laasonen 029 551 3303, rahoitus.tilinpito@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (247.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

- Revisions in these statistics

-

- Revisions in these statistics (28.9.2018)

Updated 28.9.2018

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2nd quarter 2018. Helsinki: Statistics Finland [referred: 19.4.2025].

Access method: http://stat.fi/til/rtp/2018/02/rtp_2018_02_2018-09-28_tie_001_en.html