Published: 29 April 2021

Accrued pension entitlements stood at EUR 801 billion at the end of 2018

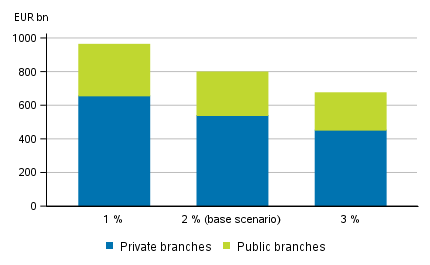

The accrued pension entitlements of Finland’s statutory earnings-related pension scheme stood at EUR 800.5 billion at the end of 2018 with a real discount rate assumption of two per cent, or 343 per cent relative to gross domestic product. The pension entitlements of the earnings-related pension scheme of private branches were EUR 541.9 billion and those of public branches were EUR 258.7 billion.

Accrued pension entitlements at different discount rates at the end of 2018, EUR million

Pension entitlements refer to the amount of money that would be enough to cover the pensions accrued by that moment discounted to present value. The amount of pension entitlements in the earnings-related pension scheme is critical to the discount rate used in the calculations: with a real discount rate of one per cent the pension entitlements were EUR 965.1 billion or 413 per cent relative to gross domestic product and with a three per cent real discount rate they were EUR 676.9 billion or 290 per cent relative to gross domestic product. Finland's earnings-related pension scheme is partially funded. According to the financial accounts, the amount of earnings-related pension assets was EUR 196.4 billion at the end of 2018. The funding ratio, i.e. the ratio of pension assets and pension entitlements was 25 per cent. More about the topic in the Tieto&trendit blog (in Finnish).

Supplementary pension table complements financial accounts

In the revision of the European System of Accounts (ESA 2010), the statistics on pension liabilities were expanded with a supplementary pension table outside the “core accounts” that contains data on all pension liabilities included in social insurance. Data for 2018 were released concerning all EU countries on Eurostat’s pages . In Finland’s case, new statistical data were the above-mentioned pension liabilities of the statutory earnings-related pension scheme that are not included in the financial accounts but that are included in the supplementary pension table. Data on the pension entitlements of the earnings-related pension scheme have been released in the Finnish Centre for Pensions’ reports Statutory pensions in Finland – Long-term projections .

In addition to the statutory earnings-related pension scheme, the pension table includes data on the pension entitlements of employment-related supplementary pension schemes that are already included in the pension entitlements of insurance corporations and voluntary pension funds in the financial accounts. The amount of pension entitlements of voluntary supplementary pension schemes describes the technical provisions. At the end of 2018 it stood at EUR 9.2 billion or four per cent relative to gross domestic product.

The supplementary pension table describes the pensions classified as social insurance. The Social Insurance Institution’s national and guarantee pensions are classified as social assistance in national accounts and are thus not included in the supplementary pension table. The key difference between social insurance and social welfare is that in case of social welfare, pensions are paid to the pension recipients regardless of whether they participate in the system by paying pension contributions or not.

When calculating the accrued pension entitlements of the statutory earnings-related pension scheme the basis is a fictive situation where the insured are paid all pensions accrued by the moment examined but no new pension is accrued. The amount of pension entitlements does not describe the sustainability of the pension system. The concept depicts future pension expenditure, i.e. pensions paid to pension recipients whose amount is affected, in addition to earned income and the rate of accrual, by life expectancies and other assumptions in the calculation model. Incomes of the earnings-related pension scheme, i.e. pension contributions and the profits from the earnings-related pension assets are not included in the calculation.

In calculations stretching long into the future, background assumptions, like the discount rate and population and economic development, are of high significance for the results. The sensitivity of the results to the discount rate assumption is emphasised by releasing the results with the three real rates mentioned above.

Private and public branches

Finland’s statutory earnings-related pension scheme in practice covers all work in both private and public branches. The earnings-related pension scheme is formed of several pension acts that together cover the various sectors of the economy. The pension liabilities based on the following pension acts are included in private branches: Employees Pensions Act (TyEL), Seamen's Pensions Act (MEL), Self-Employed Persons' Pensions Act (YEL), Farmers' Pensions Act (MYEL), supplementary pension provision under the Employees' Pensions Act (TEL-L, abolished at the end of 2016) and the pensions of the Evangelical Lutheran Church.

The pension liabilities based on the following pension acts and rules are included in public branches: Act on public branches’ pensions (JuEL, excl. church pensions), pension rules of the employees and officials of the Bank of Finland and the Provincial Government of Åland. At the beginning of 2017, the following acts were combined with the act on public branches’ pensions: Central Government's Pensions Act (VaEL), Local Government's Pensions Act (KuEL), Evangelical Lutheran Church's Pensions Act (KiEL) and the pension rules for the Social Insurance Institution's employees. Pension liabilities based on VEKL (act on the compensation of pensions from central government funds for periods of caring for a child aged under three and during studies) are included in both private and public branches.

The supplementary pension table covers all supplementary pensions managed by voluntary pension funds and foundations, as well as group pension insurance offered by insurance corporations because they are considered to belong to social insurance. In the supplementary pension tables, individual pension insurance taken out by enterprises or private persons is excluded from the definition of social insurance.

Accrual calculations of the pension entitlements in the earnings-related pension scheme

The amount of pension liabilities is calculated with a long-term planning model in the Finnish Centre for Pensions. Information on the calculation model and the pension liability calculations released by the Finnish Centre for Pensions, i.e. accrued pension entitlements can be found in the Finnish Centre for Pensions’ reports Statutory pensions - long-term calculations , especially in Appendices 3 and 8. The latest report is Statutory pensions – long-term calculations 2019 . The difference compared to the calculation of the Finnish Centre for Pensions’ report is that the supplementary pension tables use the background assumptions agreed on in the European Union’s AWG (Ageing Working Group) and recommended by Eurostat in order to improve the international comparability of the calculations.

The long-term planning model of the Finnish Centre for Pensions describes how the pension scheme works and its current regulations in detail. Future development of pensions is in the model calculated pension act specifically using age and sex-specific data on insured persons and the population of Finland.

When calculating pension entitlements, all pension entitlements accumulated by the time of examination and pensions under payment are considered. Future index increases and the effect of the life expectancy coefficient have also been considered in the amount of pension entitlements. Pension parts that are accrued based on future work or social security benefit periods are not included in accrued pension entitlements. The future part of disability pensions that will start later are not included in accrued pension entitlements.

Source: Financial accounts, Statistics Finland

Inquiries: Anna Mustonen 029 551 3651, Heidi Lauttamäki 295 513 029, rahoitus.tilinpito@stat.fi

Head of Department in charge: Katri Kaaja

Publication in pdf-format (245.4 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Pension entitlements in the end of 2018 (29.4.2021)

Updated 29.4.2021

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 13 2018. Helsinki: Statistics Finland [referred: 19.4.2025].

Access method: http://stat.fi/til/rtp/2018/13/rtp_2018_13_2021-04-29_tie_001_en.html