Published: 25 September 2020

Households’ net assets grew in 2019

Households’ financial assets amounted to EUR 331.5 billion and other assets to EUR 506.3 billion at the end of 2019. Financial assets increased by EUR 27.2 billion during the year and other assets by EUR 17.7 billion. The most important items in other assets, that is, non-financial assets, are residential buildings and land. Households’ liabilities also grew, in total by EUR 10.1 billion, so the level of liabilities rose to EUR 184.1 billion. When liabilities are deducted from financial assets and other assets, households’ net assets are EUR 653.7 billion. Compared to the previous quarter, households’ net assets grew by EUR 34.9 billion. These data appear from Statistics Finland's financial accounts statistics.

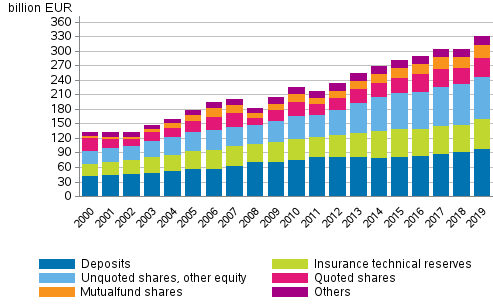

Households’ financial assets 2000–2019, EUR billion

Growth of households’ net assets continued

Households’ net assets have grown continuously after the drop in 2008. In 2019 the level of net assets was EUR 653.7 billion. In 2019, EUR 34.9 billion more net assets were accumulated. The development has been affected by the growth in both financial assets and non-financial assets. Households’ debt burden has also grown every year, but financial and non-financial assets have grown faster than indebtedness.

Deposits still continue as the biggest individual financial investment instrument. Despite low interest rates, the amount of households’ deposits grew by EUR 5.5 billion during 2019. At the end of 2019, households’ financial assets amounted to EUR 97.3 billion in deposits. As in previous years, households withdrew their assets from fixed-term deposits at the same time as transferable deposits increased.

The total value of quoted shares and mutual fund shares held by households was EUR 67.1 billion. The growth from the end of the previous year amounted to EUR 11.2 billion mainly due to holding gains.

Households’ indebtedness ratio rose by 1.8 percentage points

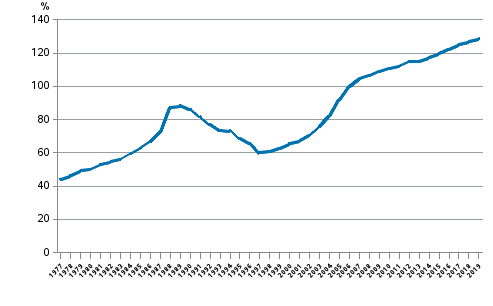

Households' indebtedness ratio has risen annually nearly continuously since 1997. The growth rate of households’ debts continued nearly unchanged in 2019 as well. Households’ loan debts amounted to EUR 156.7 billion at the end of 2019. The growth in loan debts raised households' indebtedness ratio by 1.8 percentage points over the year to 128.9 per cent. In this connection, loan debts are not compared to financial assets or total assets but to disposable income.

Households’ indebtedness ratio 1977 to 2019, loan debt in proportion to disposable income

Source: Financial Accounts, Statistics Finland

Inquiries: Timo Ristimäki 029 551 2324, Roope Rahikka 029 551 3338, rahoitus.tilinpito@stat.fi

Head of Department in charge: Mari Ylä-Jarkko

Publication in pdf-format (386.8 kB)

- Reviews

-

- 1. Households financial assets grew (25.9.2020)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Financial assets of households, million EUR (25.9.2020)

- Appendix table 2. Financial liabilities of households, million EUR (25.9.2020)

- Appendix table 3. Households´ net acquistion of financial assets, million EUR (25.9.2020)

- Appendix table 4. Households´ net incurrence of liabilities, million EUR (25.9.2020)

- Appendix table 5. Financial assets of non-financial corporations, million EUR (25.9.2020)

- Appendix table 6. Financial liabilities of non-financial corporations, million EUR (25.9.2020)

- Appendix table 7. Net financial assets by sector, million EUR (25.9.2020)

- Appendix table 8. Net financial transactions by sector, million EUR (25.9.2020)

- Appendix table 9. Statistical discrepancy by sector, million EUR (25.9.2020)

- Appendix table 10. Total assets by sector in 2019, billion EUR (25.9.2020)

- Figures

-

- Appendix figure 1. Financial assets of households (25.9.2020)

- Appendix figure 2. Change in financial assets of households (25.9.2020)

- Appendix figure 3. Households net acquisitions of deposits, quoted shares and mutual funds (25.9.2020)

- Appendix figure 4. Households indebtedness ratio (25.9.2020)

- Appendix figure 5. Private sector debt as percentage of GDP (25.9.2020)

Updated 25.9.2020

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2019. Helsinki: Statistics Finland [referred: 19.4.2025].

Access method: http://stat.fi/til/rtp/2019/rtp_2019_2020-09-25_tie_001_en.html