1. Households’ financial assets continued growing in 2020

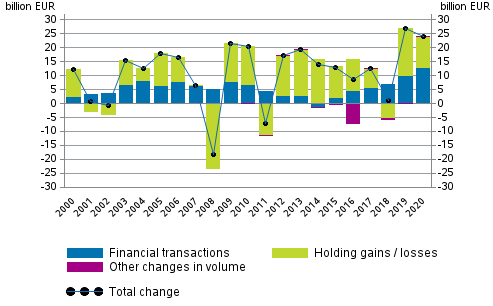

Households’ financial assets grew by EUR 23.4 billion during 2020 and rose to EUR 354.5 billion. In 2020, a total of EUR 10.9 billion were generated in holding gains, while households’ net additional investments in financial assets amounted to EUR 12.5 billion. Households' liabilities grew by EUR 10.1 billion. The difference between financial assets and liabilities was EUR 161.5 billion. Net financial assets grew by EUR 13.3 billion during the year.

Figure 1. Change in financial assets of households, EUR billion

Households’ net additional investments in financial assets grew compared with the previous year. Investments flowed most to deposits, to the net value of EUR 8.1 billion. Households still withdrew EUR 0.6 billion of their assets from fixed-term deposits in 2020, at the same time as transferable deposits increased by as much as EUR 8.7 billion.

In 2020, a change took place in the investment ratio of mutual fund shares and quoted shares. Households invested EUR 1.6 billion in both claims on net. In earlier years, investment funds have generally been clearly a more popular investment target. The value of quoted shares held by households rose by EUR 6.2 billion. In addition, households accumulated holding gains from mutual fund shares and unquoted shares.

Overall, households’ financial assets amounted to EUR 354.5 billion at the end of 2020. Of these, EUR 116.2 billion were cash and deposits, EUR 89.8 billion unquoted shares and equity, EUR 61.3 billion insurance and pension technical reserves, EUR 46.3 billion quoted shares, and EUR 31.7 billion mutual fund shares. The value of other financial assets held by households was EUR 9.3 billion. Households’ shares in housing corporations are not included in households’ financial assets in the financial accounts but they are part of other assets or non-financial assets.

The amount of housing loans and other loan debts grew during 2020 by EUR 6.7 billion and reached EUR 162.5 billion at the end of the year. Households' indebtedness ratio, or the proportion of loan debts relative to their total disposable income in the four latest quarters, rose by 5.4 percentage points to 133.3 per cent. In this connection, loan debts are not compared to financial assets or total assets but to disposable income.

1.1. General government’s financial position improved despite the coronavirus

General government’s financial position improved in 2020 despite the coronavirus. Net financial assets grew to EUR 152.4 billion, which is EUR 2.0 billion more than one year before. The changes in financial position are mainly explained by an increase of EUR 6.5 billion in the net financial assets of employment pension schemes belonging to social security funds and a decrease of EUR 4.4 billion in the net financial assets of central government. The local government sector’s net financial assets rose by EUR 0.3 billion and other social security funds' net financial assets declined by EUR 0.5 billion. The following sections discuss in more detail the development of general government's net financial assets.

At the end of 2020, the level of central government’s net financial assets was EUR 60.5 billion negative, which is EUR 4.4 billion less than at the end of 2019. The fall in net financial assets is caused by the EUR 21.4 billion growth in the volume of debt securities issued by central government. On the other hand, central government deposits were EUR 5.7 billion higher than in the year before and due to changes in the holding of quoted shares and other equity, the level of shares and equity was EUR 10.1 billion higher than in 2019.

Local government’s net financial assets grew by EUR 0.3 billion during 2020. Net financial assets stood at EUR -7.5 billion at the end of 2020. Net financial assets increased particularly as deposits increased.

Employment pension schemes’ financial assets amounted to EUR 224.7 billion. At the same time, liabilities taken into account in financial accounts amounted to EUR 6.4 billion, so the amount of employment pension schemes’ net financial assets was EUR 218.2 billion positive. Net financial assets went up by EUR 6.5 billion from the previous year. More assets flowed on net to shares and mutual fund shares to the tune of EUR 4.5 billion and holding gains amounted to EUR 3.1 billion over the year. EUR 123.2 billion or over one-half of employment pension schemes' financial assets are in mutual fund shares. Assets flowed on net to deposits to the value of EUR 4.6 billion during 2020. From 2014 onwards, employment pension schemes' investments in debt securities have been negative, and in 2020, investments in debt securities were reduced by EUR 5.9 billion.

The net financial assets of other social security funds went down by EUR 0.5 billion from the previous year. At the end of 2020, the level of net financial assets was EUR 2.2 billion. Other social security funds issued debt securities to the tune of EUR 1.3 billion during 2020. The amount of deposits grew by EUR 0.8 billion.

1.2. Non-financial corporations’ debt financing grew in 2020

Non-financial corporations' debt financing increased by EUR 9.2 billion during 2020. Debt financing refers to the total of loan debts and financing in the form of debt securities. Over the year, the stock of non-financial corporations' loan debts and debt securities grew from EUR 258.5 billion to EUR 267.7 billion. Most of the growth in debt financing came from loan debts. During the year, non-financial corporations raised new loans to the value of EUR 7.1 billion and financing in the form of debt securities increased by EUR 2.8 billion. Here, the non-financial corporations sector does not include financial and insurance corporations, housing companies or other housing corporations.

1.3. Growth in domestic mutual funds continued further

Mutual funds grew by a total of EUR 10.2 billion from one year ago and stood at EUR 146.5 billion at the end of the year. Holding gains from mutual funds amounted to EUR 6.8 billion, which explains most of the annual change. Especially foreign bodies invested in domestic mutual funds during 2020.

The value of loans granted by deposit banks was EUR 185.2 billion at the end of 2020. Of this, EUR 100.6 billion were various loans of households. At the end of 2020, the value of deposits in deposit banks was EUR 365 billion.

1.4. Liabilities of insurance corporations growing

Insurance corporations’ insurance and pension liabilities grew by EUR 2.5 billion to EUR 68 billion. The growth is explained by a EUR 1.5 billion increase in liabilities based on life insurance and annuity. Non-life insurance technical provisions grew by EUR 0.4 billion during 2020 and pension liabilities grew by EUR 0.5 billion.

Insurance corporations’ financial assets rose from EUR 77.6 billion to EUR 79.7 billion in a year. The stock of mutual fund shares rose from EUR 43 billion to EUR 45 billion. Mutual fund shares accounted for 56 per cent of insurance corporations' financial assets. Insurance corporations held long-term debt securities to the tune of EUR 15.9 billion, which is EUR 0.3 billion more than one year ago. Deposit assets remained on level with the previous year at EUR 4.6 billion.

1.5. Foreign holdings in Finnish quoted shares fell slightly

At the end of 2020, the value of foreign holdings in Finnish quoted shares was EUR 141.2 billion. The share of foreign holdings in the value of Finnish quoted shares fell by 0.7 percentage points year-on-year and was 49.3 per cent at the end of 2020.

At the end of 2020, EUR 816.2 billion of the Finnish domestic sector's financial assets had been invested abroad. At the end of the year, Finnish units owned EUR 68.4 billion worth of foreign quoted shares and EUR 145.5 billion worth of domestic quoted shares. Finns owned foreign mutual fund shares to the value of EUR 161 billion and domestic ones to the value of EUR 112.6 billion. Net investments in foreign funds amounted to EUR 4.8 billion. Together with EUR 2.0 billion in holding gains, they raised the stock of foreign mutual fund shares owned by Finns from EUR 154.1 billion to EUR 161 billion.

1.6. Private sector debt increased

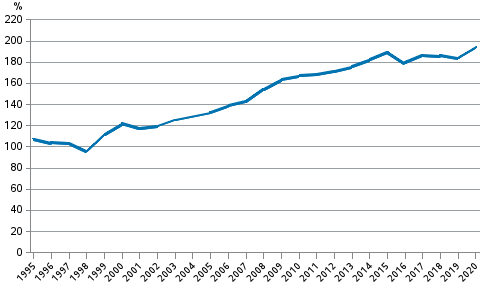

The GDP share of private sector debt increased by nine percentage points to 192.7 per cent. Private sector debt comprises the loan debts and debts in the form of debt securities of non-financial corporations, households and non-profit institutions serving households. At the end of 2020, the private sector’s stock of liabilities was valued at EUR 457.7 billion in total.

Figure 2. Non-consolidated private sector debt as percentage of GDP

Source: Financial Accounts, Statistics Finland

Inquiries: Timo Ristimški 029 551 2324, Roope Rahikka 029 551 3338, rahoitus.tilinpito@stat.fi

Head of Department in charge: Katri Kaaja

Updated 24.9.2021

Official Statistics of Finland (OSF):

Financial accounts [e-publication].

ISSN=1458-8145. 2020,

1. Households’ financial assets continued growing in 2020

. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/rtp/2020/rtp_2020_2021-09-24_kat_001_en.html