This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 29 October 2020

Profits of insurance companies grew in 2019

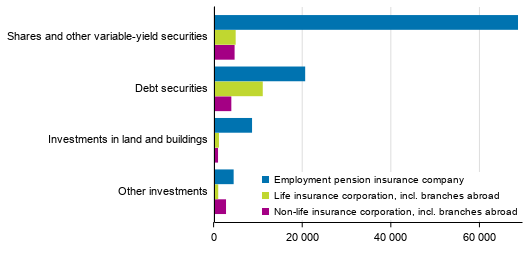

Combined profit of non-life insurance, life insurance and employment pension insurance companies for the financial period grew in 2019 to EUR 1.1 billion from the previous year's EUR 0.9 billion. Insurance companies’ investment assets amounted to EUR 131 billion on 31 December 2019. In addition, life insurance companies had investments covering unit-linked insurances to the tune of EUR 41 billion.

Insurance companies’ investment allocation on 31 December 2019, EUR million

Employment pension insurance companies

Employment pension insurance companies’ premium income and claims paid comprise statutory pension insurance. Premium income and claims paid continued growing in 2019. Premium income grew by 5.8 per cent to EUR 15.6 billion. Claims paid, in turn, increased by 5.6 per cent to EUR 16.3 billion. Claims incurred, which in addition to claims paid, include change in the provision for outstanding claims, grew from the previous year by 4.9 per cent to EUR 17.7 billion.

Investment activities were profitable for employment pension insurance companies in 2019. The net income of investments grew to EUR 6.2 billion from the previous year's EUR 1.3 billion. The income of investments grew by 33.0 per cent and the expenses increased by 17.2 per cent. Particularly higher sales profits increased income from investment activities. The balance sheet value of investments increased by 6.2 per cent to EUR 101.7 billion. Shares and participations continued growing at the same time as the share of money market instruments in investment assets continued their decline. The balance sheet value of shares and participations grew by 12.2 per cent to EUR 68.5 billion and their share was 67 per cent of all investments of employment pension insurance companies.

At the end of 2019, technical provisions totalled EUR 105.9 billion. The growth from the year before amounted to 5.2 per cent.

Life insurance companies

Life insurance companies' premium income and direct income claims paid increased in 2019. Premium income grew from the previous year's EUR 4.4 billion to EUR 6.0 billion. Claims paid increased by EUR 4.6 billion in 2018 to EUR 7.2 billion.

The net income of investment activities increased to as much as EUR 6.4 billion from EUR -1.2 billion in the year before. The income grew by 35.5 per cent to EUR 2.8 billion and the expenses decreased by 43.2 per cent to EUR 973 million. The net effect of investments’ unrealised value changes and value increases and their adjustments on the net income of investment activities grew to as much as EUR 4.5 billion from EUR -1.6 billion in the previous year. The balance sheet value of investments continued declining. The investment assets of life insurance companies totalled EUR 17.4 billion at the end of 2019, while in 2018 they stood at EUR 18.3 billion. Money market instruments are still the biggest investment item of the balance sheet, covering 62.4 per cent of all investments of life insurance companies. The role of unit-linked insurances in the business activity of life insurance companies has grown in recent years. In 2019, the balance sheet value of the investments covering unit-linked insurances was EUR 40.9 billion, that is, 12.8 per cent higher than in the previous year.

Life insurance companies’ technical provisions without unit-linked insurances diminished from the year before by 3.0 per cent to EUR 16.3 billion.

The profit for the financial period decreased to EUR 545 million from the previous year's EUR 661 million.

Non-life insurance companies

In 2019, non-life insurance companies' premium income grew by 1.1 per cent, from the previous year’s EUR 3.56 billion to EUR 3.60 billion. Claims paid increased by 3.4 per cent to EUR 2.6 billion. In most insurance classes, premium income and claims paid increased.

Operating expenses grew from EUR 756 million in 2018 by 10.0 per cent to EUR 832 million. The net income of investment activities grew by a staggering 214.0 per cent to EUR 701 million in 2019. Income grew by 58.6 per cent from the previous year’s EUR 635 million to EUR one billion. The expenses of investment activities decreased by 25.5 per cent to EUR 307 million. Sales profits significantly increased the income of investment activities. In 2019, sales profits grew by 98.6 per cent to EUR 495 million from the previous year's EUR 249 million.

Largely due to the increased income of investment activities, non-life insurance companies’ profit/loss for the financial period grew by 110.4 per cent to EUR 539 million from the previous year's EUR 256 million. The balance sheets of non-life insurance companies grew by 4.4 per cent compared to the previous year, amounting to EUR 14.3 billion at the end of 2019. Investment assets remained at a very similar level as in the previous year, amounting to EUR 11.6 billion. On the liability side of the balance sheets, technical provisions grew from EUR 9.6 billion in 2018 to EUR 9.7 billion. Own equity grew by 15.1 per cent from the previous year's EUR 3.2 billion to EUR 3.7 billion.

More detailed information on insurance activities can be found in the database and appendix tables of the statistics and from the web pages of other organisations that produce insurance data (see the left-hand menu under "Links" on the statistics' home page). The statistics on insurance activities cover activity data of employment pension insurance, life insurance and non-life insurance companies, such as profit and loss account, balance sheet, investments and class of insurance specific data. The data are based on the Financial Supervisory Authority's data collection on domestic activities of corporations engaged in the insurance markets. The financial statement structure differs in many respects between employment pension insurance, life insurance and non-life insurance companies. The data concerning life insurance and non-life insurance companies also include branches abroad. Further information about the statistics and financial statement concepts is available in the quality description of the statistics.

Source: Insurance Activities 2019, Statistics Finland

Inquiries: Heidi Lauttamäki 029 551 3029, Jarkko Kaunisto 029 551 3551, rahoitusmarkkinat@stat.fi

Head of Department in charge: Mari Ylä-Jarkko

Publication in pdf-format (329.2 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Balance sheets of insurance companies 2019, EUR million (29.10.2020)

- Appendix table 2. Investment income of insurance companies 2019, EUR million (29.10.2020)

- Appendix tabel 3. Insurance class-specific data of life insurance companies 2019 (29.10.2020)

- Appendix tabel 4. Insurance class-specific data of non-life insurance companies 2019 (29.10.2020)

- Figures

-

- Appendix figure 1. Distribution of insurance companies insurance premiums, EUR million (29.10.2020)

- Appendix figure 2. Distribution of insurance companies claims paid, EUR million (29.10.2020)

- Appendix figure 3. Insurance companies net profits from investments, EUR million (29.10.2020)

- Appendix figure 4. Non-life insurance companies premium income - class-specific data, EUR million (29.10.2020)

- Appendix figure 5. Life insurance companies number of insured in 2019 - class-specific data, pcs (29.10.2020)

Updated 29.10.2020

Official Statistics of Finland (OSF):

Insurance Activities [e-publication].

ISSN=2341-7625. 2019. Helsinki: Statistics Finland [referred: 19.4.2025].

Access method: http://stat.fi/til/vato/2019/vato_2019_2020-10-29_tie_001_en.html