This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 28 October 2021

Profits of insurance companies declined in 2020

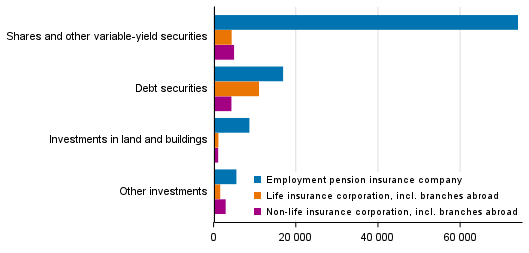

Non-life insurance, life insurance and employment pension insurance companies’ combined profit for the financial period declined in 2020 to EUR 1.0 billion from the previous year's EUR 1.1 billion. Insurance companies’ investment assets amounted to EUR 134 billion on 31 December 2020. In addition, life insurance companies had investments covering unit-linked insurances to the tune of EUR 43 billion.

Insurance companies’ investment allocation on 31 December 2020, EUR million

Employment pension insurance companies

Employment pension insurance companies’ premium income and claims paid comprise statutory pension insurance. Premium income turned to a decline and claims paid continued growing in 2020. Premium income fell by 8.2 per cent to EUR 14.3 billion. Claims paid, in turn, increased by 0.5 per cent to EUR 16.4 billion. Claims incurred, which in addition to claims paid, include change in the provision for outstanding claims, grew from the previous year by 2.3 per cent to EUR 18.1 billion.

Investment activities were still profitable for employment pension insurance companies in 2020. The net income of investments decreased to EUR 5.4 billion from EUR 6.2 billion in 2017. The income of investments grew by 6.7 per cent and the expenses increased by 10.5 per cent. The balance sheet value of investments increased by 2.6 per cent to EUR 104.3 billion. Shares and participations continued growing at the same time as the share of money market instruments in investment assets continued their decline. The balance sheet value of shares and participations grew by 7.8 per cent to EUR 73.8 billion and their share was 71 per cent of all investments of employment pension insurance companies.

At the end of 2020, technical provisions totalled EUR 110 billion. The growth from the year before amounted to 3.9 per cent.

Life insurance companies

Life insurance companies’ premium income and direct income claims paid decreased in 2020. Premium income fell from the previous year's EUR 6.0 billion to EUR 4.0 billion. Claims paid diminished by EUR 7.2 billion in 2019 to EUR 4.2 billion.

The net income of investment activities went down to EUR 2.9 billion from EUR 6.4 billion in the year before. The income fell by 26.2 per cent to EUR 2.1 billion and the expenses rose by 42.5 per cent to EUR 1.4 billion. The net effect of investments’ unrealised value changes and value increases and their adjustments on the net income of investment activities fell to EUR 2.2 billion from EUR 4.5 billion in the previous year. The balance sheet value of investments continued declining. The investment assets of life insurance companies totalled EUR 17.2 billion at the end of 2020, while in 2019 they stood at EUR 17.4 billion. Money market instruments are still the biggest investment item of the balance sheet, covering 62.6 per cent of all investments of life insurance companies. In 2020, the balance sheet value of the investments covering unit-linked insurances was EUR 43.3 billion, that is, 6.0 per cent higher than in the previous year.

Life insurance companies’ technical provisions without unit-linked insurances diminished from the year before by 5.2 per cent to EUR 15.5 billion.

The profit for the financial period grew to EUR 591 million from the previous year's EUR 545 million.

Non-life insurance companies

In 2020, non-life insurance companies' premium income grew by 6.5 per cent, from the previous year’s EUR 3.60 billion to EUR 3.83 billion. Claims paid remained almost on level with the previous year at EUR 2.6 billion. In most insurance classes, premium income increased and claims paid decreased.

Operating expenses fell from EUR 832 million in 2019 by 6.9 per cent to EUR 774 million. The net income of investment activities fell by 53.2 per cent to EUR 328 million in 2020. The income decreased by 33.2 per cent to EUR 673 million. The expenses of investment activities grew by 12.5 per cent to EUR 345 million. The decline in sales profits explains most of the fall in income. In 2020, sales profits went down by 42.4 per cent to EUR 285 million from the previous year's EUR 495 million.

Non-life insurance companies’ profit/loss for the financial period declined by 18.8 per cent to EUR 437 million from the previous year's EUR 539 million. The balance sheets of non-life insurance companies grew by 6.2 per cent compared to the previous year, amounting to EUR 15.2 billion at the end of 2020. Investment assets grew by 6.5 per cent from the previous year, amounting to EUR 12.4 billion. On the liability side of the balance sheets, technical provisions grew from EUR 9.7 billion in 2019 to EUR 10.1 billion. Own equity grew by 13.0 per cent from the previous year's EUR 3.7 billion to EUR 4.2 billion.

More detailed information on insurance activities can be found in the database and appendix tables of the statistics and from the web pages of other organisations that produce insurance data (see the left-hand menu under "Links" on the statistics' home page). The statistics on insurance activities cover activity data of employment pension insurance, life insurance and non-life insurance companies, such as profit and loss account, balance sheet, investments and class of insurance specific data. The data are based on the Financial Supervisory Authority's data collection on domestic activities of corporations engaged in the insurance markets. The financial statement structure differs in many respects between employment pension insurance, life insurance and non-life insurance companies. The data concerning life insurance and non-life insurance companies also include branches abroad. Further information about the statistics and financial statement concepts is available in the quality description of the statistics.

Source: Insurance Activities 2020, Statistics Finland

Inquiries: Matias Hämäläinen 029 551 3737, Jukka-Pekka Pyylampi 029 551 3002, rahoitusmarkkinat@stat.fi

Head of Department in charge: Katri Kaaja

Publication in pdf-format (331.3 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Balance sheets of insurance companies 2020, EUR million (28.10.2021)

- Appendix table 2. Investment income of insurance companies 2020, EUR million (28.10.2021)

- Appendix tabel 3. Insurance class-specific data of life insurance companies 2020 (28.10.2021)

- Appendix tabel 4. Insurance class-specific data of non-life insurance companies 2020 (28.10.2021)

- Figures

-

- Appendix figure 1. Distribution of insurance companies insurance premiums, EUR million (28.10.2021)

- Appendix figure 2. Distribution of insurance companies claims paid, EUR million (28.10.2021)

- Appendix figure 3. Insurance companies net profits from investments, EUR million (28.10.2021)

- Appendix figure 4. Non-life insurance companies premium income - class-specific data, EUR million (28.10.2021)

- Appendix figure 5. Life insurance companies number of insured in 2020 - class-specific data, pcs (28.10.2021)

Updated 28.10.2021

Official Statistics of Finland (OSF):

Insurance Activities [e-publication].

ISSN=2341-7625. 2020. Helsinki: Statistics Finland [referred: 18.4.2025].

Access method: http://stat.fi/til/vato/2020/vato_2020_2021-10-28_tie_001_en.html