This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 15 December 2017

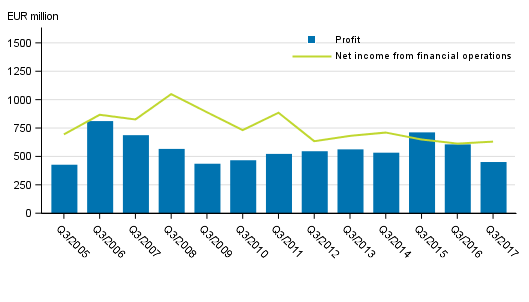

Net income from financial operations of banks operating in Finland grew, but operating profit decreased in the third quarter of 2017

In the third quarter of 2017, the net income from financial operations of credit institutions engaged in banking in Finland amounted to EUR 630 million and their operating profit was EUR 451 million. The net income from financial operations went up by EUR 17 million and the operating profit declined by EUR 155 million from one year ago. These data derive from Statistics Finland’s financial statement statistics on credit institutions.

Net income from financial operations and operating profit of banks operating in Finland, 3rd quarter 2005 to 2017, EUR million

Interest income and expenses

Credit institutions engaged in banking in Finland accumulated EUR 1.3 billion in interest income in the third quarter, which was EUR 118 million more than one year previously. Interest expenses, in turn, increased by EUR 101 million year-on-year to EUR 650 million. Thus the net income from financial operations calculated as the difference between interest income and expenses grew by EUR 17 million or around three per cent. Measured in percentages, interest income grew by 10 per cent and expenses by 18 per cent.

Administrative expenses

Administrative expenses are the single largest expenditure item of banks operating in Finland. In the third quarter, banks had EUR 672 million in administrative expenses, which was EUR 13 million more than in the year before. Wages and salaries represented 45.8 per cent of administrative expenses. Compared to the third quarter of 2016, total wages and salaries decreased by EUR 20 million to EUR 307 million.

Operating profit

The operating profit, or profit from continuing operations before taxes, was EUR 451 million. Compared with the EUR 606 million last year, the operating profit decreased by EUR 155 million or 26 per cent. In particular, clearly decreased gains on financial assets and liabilities held for trading explain the drop in the operating profit. Fluctuations in the operating profit by quarter can be large.

Balance sheet

The aggregate value of the balance sheets was EUR 372 billion. The balance sheet was 33.2 per cent down from one year ago. The share of own equity in the total of the balance sheets was 4.6 per cent or around EUR 17 billion. Banks’ own equity declined by EUR 10 billion year-on-year.

A company restructuring made in the Finnish banking sector in the first quarter of 2017 explains a majority of the unexceptionally large changes in the balance sheets and, in particular, in equity.

Source: Credit institutions' annual accounts, Statistics Finland

Inquiries: Jarkko Kaunisto 029 551 3551, Pekka Tamminen 029 551 2460, rahoitusmarkkinat@stat.fi

Director in charge: Ville Vertanen

Publication in pdf-format (267.6 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 15.12.2017

Official Statistics of Finland (OSF):

Financial statement statistics on credit institutions [e-publication].

ISSN=2342-5180. 3rd quarter 2017. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/llai/2017/03/llai_2017_03_2017-12-15_tie_001_en.html