Published: 15 December 2015

Current account showed a surplus in the third quarter, net international investment position decreased

The current account was in surplus in the third quarter of 2015, despite the decrease in exports. Financial assets and liabilities decreased. These data derive from Statistics Finland's balance of payments and international investment position statistics.

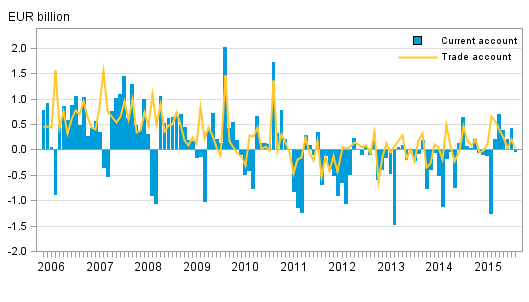

Finland’s current account and trade account

Current account in the third quarter of 2015

The current account showed a surplus of EUR 1.0 billion in the third quarter of 2015 due to the surplus in trade in goods and the primary income account. Exports and imports of both goods and services decreased from the corresponding period last year. In both items imports declined more than exports.

The goods account in balance of payment terms was EUR 0.5 billion in surplus as exports of goods amounted to EUR 13.4 billion and imports to EUR 12.9 billion. As a whole, exports declined by 5.0 per cent and imports by 7.0 per cent compared with the corresponding period in 2014.

The service account was in balance in the third quarter of 2015. Exports of services amounted to EUR 5.2 billion, which was 6.1 per cent lower than in the year before. Exports decreased most in charges for the use of intellectual property n.i.e and in telecommunication, computer and information services. The most important items in service exports were telecommunication, computer and information services, other business services and travel. Imports of services decreased by 7.4 per cent and the total value of service imports amounted to EUR 5.3 billion. Imports decreased in particular in the item other business services.

The primary income account was EUR 1.0 billion in surplus as a result of the surplus of investment income. Net investment income, covering e.g. interest payments and dividends, paid to Finnish residents from abroad amounted to EUR 0.9 billion and was mainly in the form of dividends. Investment income to Finnish residents amounted to EUR 3.5 billion, while those to foreign residents were EUR 2.7 billion. The secondary income account was EUR 0.4 billion in deficit.

The calculation method for travel exports has changed from the third quarter of 2015 hence the figures for service exports are not comparable with previous quarters.

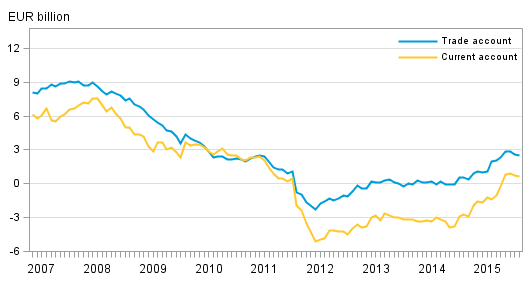

Current account in October 2015

In October, the current account was in balance, as the primary income account was in surplus while the service account and the secondary income account were in deficit. The 12-month moving total of the current account was EUR 0.6 billion in surplus.

Finland’s current account and trade account, 12 -month moving sum

Financial account and net international investment position

In the third quarter of 2015, net outflow from Finland amounted to EUR 1.6 billion as the financial account liabilities decreased more than the assets. Capital outflow took place mainly in the form of other investments (loans, deposits and trade credits), totalling EUR 2.1 billion, and inflow was mainly in the form of portfolio investments, EUR 0.9 billion.

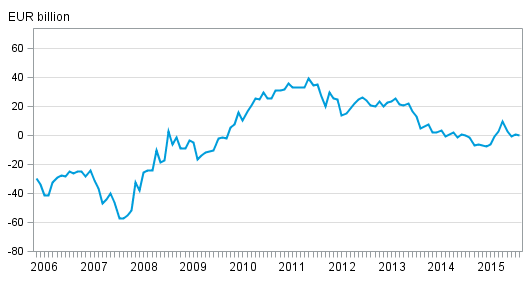

At the end of September 2015, Finland had EUR 731.9 billion in foreign assets and EUR 731.1 billion in foreign liabilities. The net international investment position was still positive at the end of the third quarter, there were EUR 0.8 billion more assets than liabilities. Both foreign assets and liabilities have decreased in the past two quarters but both are still at a higher level compared to the end of the third quarter of 2014 when foreign assets amounted to EUR 710.0 billion and liabilities to EUR 709.8 billion. Price changes related to foreign assets and liabilities cut the net international investment position by EUR 6.0 billion in the third quarter. Adjustments in exchange rates and other valuation changes also weakened the net international investment position by EUR 4.1 billion.

When examining the international investment position at sector level, the foreign assets of money market funds and collective investment schemes, social security funds and households exceeded the liabilities. Non-financial corporations, monetary financial institutions (excluding the central bank), central government and local government had more foreign liabilities than assets.

Table 1. External assets and liabilities by investment type in 2015 Q3, EUR billion

| Opening positiion 30.09.2015 | Financial transactions 2015 Q3 | Price changes 2015 Q3 | Changes in the exchange rates and valuation adjustments 2015 Q3 | Closing position 30.9.2015 | |

| Financial account | 9,3 | 1,6 | -6,0 | -4,1 | 0,8 |

| Assets | 753,1 | -22,9 | 9,2 | -7,5 | 731,9 |

| Liabilities | 743,8 | -24,6 | 15,3 | -3,4 | 731,1 |

| Direct investment | 12,0 | 1,4 | -1,1 | -4,5 | 9,8 |

| Assets | 131,6 | 2,2 | -1,1 | -2,9 | 129,8 |

| Liabilities | 119,6 | 0,8 | 0,0 | -0,4 | 120,0 |

| Portfolio investment | 5,5 | -0,9 | -4,1 | -1,3 | -0,8 |

| Assets | 299,4 | -2,8 | -9,8 | -1,8 | 285,0 |

| Liabilities | 293,8 | -1,9 | -5,7 | -0,4 | 285,8 |

| Other investment | -23,5 | 2,1 | 0,0 | 0,3 | -21,1 |

| Assets | 206,1 | -6,4 | 0,0 | -1,3 | 198,4 |

| Liabilities | 229,6 | -8,5 | 0,0 | -1,6 | 219,5 |

| Financial derivatives | 5,8 | -0,9 | -0,8 | -0,6 | 3,5 |

| Reserve assets | 9,5 | 0,0 | -0,1 | -0,1 | 9,3 |

Direct Investment

At the end of September 2015 direct investment assets on gross stood at EUR 129.8 billion and liabilities at EUR 120.0 billion. In the third quarter, direct investment assets, with price changes and changes in exchange rates and other valuation adjustments included decreased by EUR 1.8 billion and liabilities grew by EUR 0.4 billion. The most significant changes in the third quarter occurred in equity, where assets grew by EUR 3.0 billion and liabilities by EUR 1.1 billion.

Direct investment assets exceed the liabilities, however, the net international investment position related to these investments has decreased further during 2015. At the end of 2014, assets exceeded liabilities by EUR 19.3 billion but at the end of September 2015, the difference was only EUR 9.8 billion.

Portfolio Investment

At the end of September 2015 portfolio investment assets stood at EUR 285.0 billion and liabilities at EUR 285.8 billion, portfolio related liabilities exceeding portfolio assets by 0.8 billion. At the end of the previous quarter, there were still more assets than liabilities and the effect on the net international investment position at that time was EUR 5.5 billion positive. During the third quarter capital flowed out from both portfolio assets and liabilities, the net effect was EUR -0.9 billion. In addition, price changes as well as adjustments in exchange rates and other valuation changes had a decreasing effect on portfolio investments.

At the end of September 2015, Finnish residents had EUR 139.5 billion assets in foreign equity and investment fund shares and EUR 89.3 billion in liabilities, and EUR 145.5 billion in assets in debt securities and EUR 196.4 billion in liabilities. In the third quarter, non-resident investors decreased investments in equity and investmentl fund shares in Finland by EUR 0.8 billion, while Finnish residents increased their investments in international equity and investment fund shares by EUR 1.7 billion. Assets from debt security investments went down by EUR 4.5 billion and liabilities by EUR 1.1 billion.

Of foreign assets related to equity that totalled EUR 45.1 billion, collective investment schemes (excl. money market funds) held EUR 25.0 billion and general government (mainly employment pension schemes) EUR 11.7 billion. Non-financial corporations and other financial intermediaries had most equity liabilities, EUR 56.7 billion and 14.8 billion, respectively. At the end of September, Finnish households had EUR 5.9 billion in foreign assets in equity and investment fund shares.

Foreign debt security assets and liabilities mainly consist of long-term debt securities. General government (incl. central government, local government and social security funds) had a total of EUR 38.1 billion in debt securities-related assets and EUR 97.4 billion in liabilities.

Financial Derivatives and Other Investments

At the end of the third quarter, Finnish residents’ net assets from derivatives amounted to EUR 3.5 billion, which is EUR 2.3 billion less than at the end of June.

Other investment, i.e. loans, deposits and trade credits, assets and liabilities decreased compared with the previous quarter. The net investment position related to these investments improved by EUR 2.4 billion due to decrease in liabilities by EUR 10.1 billion while assets decreased by EUR 7.7 billion. At the end of September, assets from other investments amounted to EUR 198.4 billion and liabilities to EUR 219.5 billion

Financial Account and International Investment Position in October

In October, financial account showed a net outflow of EUR 0.4 billion. During the month, Finnish investors scaled down their international holdings by EUR 19.3 billion and non-resident investors decreased their investments in Finland by EUR 19.7 billion. The main source of capital inflow was other investments, EUR 2.9 billion. Outflow was highest in portfolio investments, EUR 3.4 billion.

The net international investment position was in balance at the end of October, as foreign assets amounted to EUR 733.4 billion and foreign liabilities to EUR 733.4 billion.

The data for November 2015 will be published on 15 January 2016.

Finland’s international investment position monthly

Source: Balance of payments and international investment position, Statistics Finland

Inquiries: Mira Malhotra 029 551 3411, Katri Kaaja 029 551 3488, balanceofpayments@stat.fi.

Director in charge: Ville Vertanen

Publication in pdf-format (309.0 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Appendix table 1. Finland's current account, quarterly 2015, EUR million (15.12.2015)

- Appendix table 2. External assets and liabilities by sector, quarterly 2015, EUR million (15.12.2015)

- Appendix table 3. International investment position by sector, quarterly 2015, EUR million (15.12.2015)

- Appendix table 4. Finland's balance of payments 2015, EUR million (15.12.2015)

Updated 15.12. 2015

Official Statistics of Finland (OSF):

Balance of payments and international investment position [e-publication].

ISSN=2342-348X. October 2015. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/mata/2015/10/mata_2015_10_2015-12-15_tie_001_en.html