This set of statistics has been discontinued.

New data are no longer produced from the statistics.

Published: 15 October 2020

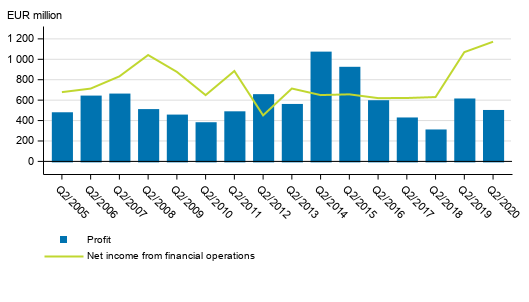

Net income from financial operations of banks operating in Finland increased and operating profit decreased in the second quarter of 2020

In the second quarter of 2020, the net income from financial operations of credit institutions engaged in banking in Finland amounted to EUR 1.2 billion and their operating profit to EUR 504 million. These data derive from Statistics Finland’s financial statement statistics on credit institutions..

Net income from financial operations and operating profit of banks operating in Finland, 2nd quarter 2005 to 2020, EUR million

Interest income and expenses

In the second quarter of 2020, credit institutions engaged in banking in Finland accumulated EUR 1,662 million in interest income. Their interest expenses, in turn, amounted to EUR 490 million. The net income from financial operations calculated as the difference between these was EUR 1,172 million, which was EUR 102 million more than one year earlier. Net income went up by EUR 25 million from the previous quarter.

Administrative expenses

Administrative expenses are a significant expense item for banks operating in Finland. In the second quarter, banks had EUR 1,180 million in administrative expenses, which was EUR 103 million less than in the corresponding quarter of the year before. Relative to the quarter one year ago, administrative expenses decreased among bank groups especially for Finnish commercial banks. Wages and salaries made up EUR 774 million or 65.6 per cent of administrative expenses.

Operating profit/loss

The operating profit, or profit from continuing operations before taxes, was EUR 504 million in the second quarter of 2020. The decrease was EUR 112 million from EUR 616 million in the second quarter of 2019. The operating profit was weakened especially by reductions in value directed to profit and loss account items and credit loss reserves.

Balance sheet

The aggregate value of the balance sheets of banks was EUR 751 billion. Of this, the share of equity was, on average, 5.9 per cent or EUR 44 billion. Cooperative banks belonging to OP Financial Group had the biggest share of equity in the balance sheet, around 11.4 per cent and foreign banks the smallest, around 0.4 per cent. On average, the share of equity in the aggregate of the balance sheets for all banks operating in Finland fell by 0.10 percentage points from one year back.

Source: Credit institutions' annual accounts, Statistics Finland

Inquiries: Jukka-Pekka Pyylampi 029 551 3002, Heidi Lauttamäki 029 551 3029, rahoitusmarkkinat@stat.fi

Head of Department in charge: Mari Ylä-Jarkko

Publication in pdf-format (272.7 kB)

- Tables

-

Tables in databases

Pick the data you need into tables, view the data as graphs, or download the data for your use.

Appendix tables

- Figures

Updated 15.10.2020

Official Statistics of Finland (OSF):

Financial statement statistics on credit institutions [e-publication].

ISSN=2342-5180. 2nd quarter 2020. Helsinki: Statistics Finland [referred: 20.4.2025].

Access method: http://stat.fi/til/llai/2020/02/llai_2020_02_2020-10-15_tie_001_en.html